[Ishika Garg is a 4th year B.A., LL.B. (Hons.) student at the NALSAR University of Law]

Navigating the legalities associated with cross-border demergers (‘CBDs’) has always been a tricky task. The Indian position on this subject has been especially muddled, with a lack of sufficient clarity from both the legal enactments and judicial forums. A post on this Blog has previously noted how the existing laws can be purposively interpreted to include the regulation of such demergers in India. It is submitted that this view is correct as a wider interpretation of India’s cross-border restructuring framework would indeed help build a conducive environment to invite a greater flow of foreign direct investment and support the government’s policy of ease of doing business. However, it is the author’s opinion that a matter this important should not be left to judicial discretion. Only a separate framework can adequately address the intricacies associated with this restructuring option. Drawing upon the praiseworthy features and taking care to avoid the pitfalls of the legal provisions for cross-border demergers in the European Union (‘EU’), this post proposes a comprehensive framework to recognise and regulate these demergers in India.

Analysing the Law in the EU

The EU Mobility Directive came into effect earlier this year and aims at creating a set of harmonised rules for cross-border restructuring in the EU in order to minimise roadblocks in the enjoyment of the freedom of establishment codified in Article 49 of the Treaty on the Functioning of the European Union. Even before this directive was operationalised, European courts had been interpreting the freedom under Article 49 broadly to conclude that allowing domestic demergers but barring CBDs would run contrary to the spirit of the article. CBDs were thus viewed as a necessary extension of legalising domestic mergers, and this is a position that the Indian tribunals could have also taken given the spirit of economic freedom embedded in our Constitution. Regardless, the latest directive specifies three channels for CBDs: first, a company may decide to ‘spin off’ an entire line of business to a separate entity while still retaining some business for itself; second, a conglomerate may ‘split up’ the work it does into two different entities, and cease to exist itself; and lastly, a demerged corporation may become the sole shareholder of the resulting entity, thus moulding the latter in the nature of a subsidiary of the former. The importance of this last category is more practical than theoretical. Imagine a situation where a company expands into a new jurisdiction through a mere representative office. Thereafter, if a corporation enjoys great success in this jurisdiction, it can establish a stronger presence there through a CBD by separation in order to effectively create a subsidiary. Despite its attractions, there are several shortcomings in the EU framework which India should take care to avoid.

The EU Directive only allows demerging assets to a new corporation and not into an existing entity in order to avoid complexities. Thus, a demerger for the purposes of absorption, i.e., where the acquiring entity is already in existence, is not possible directly. It can be done indirectly by first undertaking a domestic demerger and then a cross-border merger with the existing entity. However, this unnecessarily introduces complexities in the process, which is what the Directive set out to avoid in the first place. Furthermore, the scope of the Directive is such that it restricts the option of CBDs to limited liability corporations only. This is perhaps because corporate restructuring options for other forms of companies are governed by separate rules in the EU. However, in drawing inspiration from this Directive in the Indian context, care must be taken to differentiate on this point and extend the benefit of CBDs to all forms of companies. In doing so, separate procedural rules may be framed for different categories of companies, keeping in mind policy choices to avoid potential misuses of CBDs that the Legislature may foresee.

A Blueprint for Cross-Border Demergers in India

The need for separate provisions in the Companies Act, 2013 to tackle CBDs cannot be overemphasised. Undeniably, CBDs are attractive tools in order to simplify corporate structures, adapt to the ever-changing market conditions and reap the benefits of new opportunities in the global market. It is important to concede to the criticism that the ultimate end-goal of CBDs can be achieved through other means as well. For instance, let us assume an Italian travel and tourism company ‘A’ wishes to spin-off its tourism line of business to a new Australian corporation ‘B’ established for this purpose, while retaining the travel business for itself. Instead of doing this through a CBD, company ‘A’ could always proceed by first creating a new entity ‘C’ in Italy itself and then transferring all assets relevant to tourism to ‘C’. Thereafter, it could pursue a cross-border merger between ‘C’ and ‘B’. However, this process is unnecessarily time-consuming and highly cost-intensive, further underscoring the need for separate legal provisions for CBDs. Another factor to be considered is that CBDs may be abused in order to carefully divide a corporation’s assets in a manner that puts creditors or employees at a disadvantage. However, isolated instances of abuse should not serve as a basis for denying corporations which comply with the law the attractive opportunity of CBDs. Instead, to tackle concerns of misuse, an appropriate legal framework can be put in place. Having established that separate provisions for CBDs are indeed required, one must now outline what these might look like. The first question to be answered is what types of CBDs should be legalised in India. In the author’s opinion, the three categories in the EU Directive are sufficiently comprehensive and can be transposed in India. These categories can be better understood through the following illustrations:

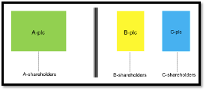

- Split-Up: A company ‘A’ transfers all of its assets and liabilities to more than one entity in exchange for the allocation of equity in the resulting companies (entities ‘B’ and ‘C’ in the below diagram) to the shareholders of ‘A’ i.e., the demerged company.

Figure 1.1: Split-Up

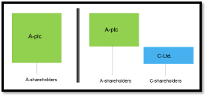

- Spin-Off: An entity ‘A’ spins off a part of its assets to one or more corporations in return for equity in these corporations being allotted to the shareholders of ‘A’.

Figure 1.2: Spin-Off

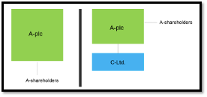

- Hive-Down: A company ‘A’ hives down a part of its assets by transferring it to one or more corporations in exchange for equity in these corporations being allotted to ‘A’ directly, and not its shareholders or members.

Figure 1.3: Hive-Down

Any provision dealing with CBDs in India should explicitly outline these three options. Additionally, there is a case to be made in favour of not limiting the CBD provisions to restrict demergers for the purposes of absorption as the EU Directive does. The reason is that, as outlined above, the goal sought to be achieved through such demergers can be attained through the combination of a domestic demerger and a cross-border merger, both of which are legal in India, in any case. Thus, to simplify the process, the law would be better placed in recognising such demergers while providing for any limitations required in order to protect the interests of all of the parties’ involved.

The proposed provision should also have built-in safeguards in order to avoid any potential abuse of CBD routes. For starters, companies in distress or insolvent companies should not be allowed to avail of the CBD provisions. This is important to ensure that companies do not exploit the CBD mechanism to avoid winding-up or insolvency proceedings as allowing such evasion would adversely affect creditors, the protection of whose rights is increasingly important in light of transition of Indian corporate law towards the stakeholder model. Moreover, the provisions should empower the Registrar of Companies or any other competent authority to disallow the CBD if, upon an examination of the facts of a given restructuring proposal, it is found that the demerger is aimed at unduly evading tax liabilities or prejudicing rights of employees, creditors, or minority shareholders. Care must be taken to outline the grounds for abuse (for instance, tax evasion or avoidance of compliance with labour standards) in clear and specific terms, as broad phrases may lead to the conferral of an overly wide discretionary power upon the competent authority, opening up the doors for arbitrary exercise of power.

The CBD provisions should be designed keeping in mind the protection of the interests of minority shareholders, which was one of the key drivers of the 2013 Companies Act. It is suggested that a right to exit be provided to minority shareholders with a guarantee of provision of adequate compensation in any case of CBD. Moreover, specific safeguards should be instilled in cases of disproportionate demergers since these risk the possibility of minority shareholders being ‘squeezed-out’. It is true that the Companies Act through its section 236 recognises the ‘rule of majority’ principle, set outin the case of Foss v. Harbottle [1843] 67 ER 189, according to which minority shareholders have no choice but to be bound by the majority’s decision. However, in cases of such squeezing-out, the Indian corporate law framework requires the payment of the fair value or a higher price for the minority’s equity, as per rule 27 of the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016. This protection should also be applied in the context of those CBDs which lead to the squeezing-out of the minority shareholders.

Lastly, care must be taken to clearly delineate the applicable laws in cases of CBDs, considering the jurisdiction of the demerging company may have different procedural and form requirements when compared to the law of the land of the resulting company. In this regard, the EU Mobility Directive presents a creative solution that could potentially be adopted in the Indian case too. The Directive provides for a pre-division certificate to be issued by the competent authority after scrutinising the legality of the application for CBD before it. If found to be for abusive purposes like tax evasion, the CBD can be outrightly denied. However, if the application is indeed legitimate, the certificate may be granted. In the time period before the grant of this certificate, the law of the host state of the demerging company is to apply. Thus, all the procedures and formalities present in the host state’s law must be adhered to right from the drafting of the application to the approval of the pre-division certificate.

Thereafter, the application shall be put forth before the competent authority in the resulting company’s country. At this stage, which is after the grant of the pre-conversion certificate, the resulting company’s jurisdictional laws and the procedural requirements therein are to be followed. Thus, the pre-conversion certificate serves as a differentiating boundary which neatly divides and places the entire CBD timeline into the legal frameworks of the different states involved. A similar approach could be followed in India, with a pre-conversion certificate or any other similar instrument serving the purpose of demarcating the applicable laws to avoid potential confusion due to contradictory laws.

Conclusion

While conflicting orders have clouded the legal position on CBDs in India with a great deal of uncertainty, a broad interpretative approach reveals that such demergers cannot be said to be against the legislative intent of the Parliament. In any case, it would be in the interest of all stakeholders involved to clarify the position through an explicit provision that recognises CBDs and outlines the procedures and safeguards that are associated therewith. In designing this provision, the EU legal framework provides a good roadmap of the dos and don’ts when it comes to regulating CBDs.

– Ishika Garg

Leave a comment