[Vinita Nair is a Senior Partner at Vinod Kothari & Co.]

In PTC India Financial Services Limited v. Venkateshwar Kari, the Supreme Court of India brought out a very important distinction between the meaning of ‘beneficial owner’ under the depository legislation, and the right of the pledgee or security interest holder to cause the sale of goods pledged by pledgor in terms of the rights arising under the pledge. For a detailed analysis of the Court’s ruling, please see here. The PTC India ruling inter alia holds that “beneficial ownership” in the context of the Depositories Act should not be confused with beneficial ownership under general law. Obtaining registration as a “beneficial owner” in terms of section 10 of Depositories Act, 1996 read with regulation 58(8) of the SEBI (Depositories and the Participants) Regulations, 1996 does not amount to any transfer of title to the pledgee. It is merely a procedural precondition to sale by the pledgee. The ruling further stipulates that there is no concept of ‘sale to self’ by the pledgee and that the pledgee is bound by the two options provided under section 176 of the Indian Contract Act, 1872, viz., the right to bring a suit against the pledgor and to retain the goods pledged as collateral security, or to sell the thing pledged on giving reasonable notice to the pledgor and sue for the balance, if any.

These observations necessitate that the Securities and Exchange Board of India (SEBI) examine the provisions of Depositories Regulations and the SEBI (Substantial Acquisition and Takeovers) Regulations, 2011 to avoid any discord or ambiguity resulting in instability or confusion, especially as to the applicability of Takeover Regulations when the pledgee exercises its right to be recorded as a ‘beneficial owner’, while reserving its right to sell the shares pledged.

Procedure and Different Stages in Case of Pledge

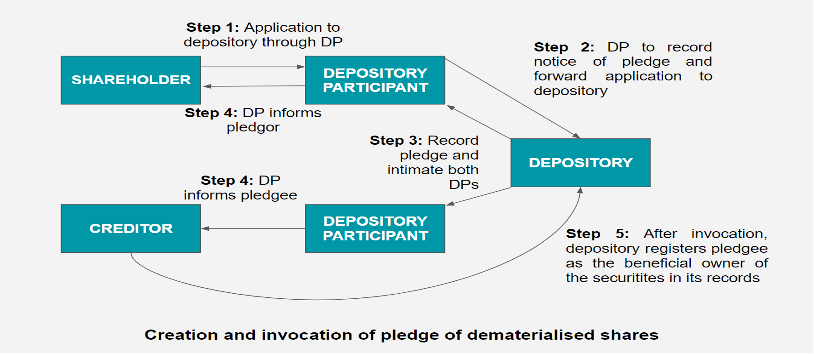

The following diagram provided in the article ‘Broken Pledge? Apex Court reviews the law on pledges’ explains in a nutshell the procedure for a pledge in case of dematerialised securities:

There are various stages in case of pledge, as discussed hereunder:

|

Stages in a pledge transaction |

Whether it involves a transfer or change of hands |

|

Creation of pledge |

No |

|

Release of pledge |

No |

|

Notice of invocation of pledge |

No |

|

Invocation of pledge |

Yes. However, in view of the rationale provided in the PTC India ruling, the registration of the pledgee as a beneficial owner is only to enable the pledgee to exercise the right under section 176 of the Contract Act. |

|

Redemption of pledged goods |

Yes, from the pledgee’s demat account to the pledgor’s demat account. However, in view of rationale provided in the PTC India ruling, if the pledgee was not the transferee or beneficial owner of the shares, the release of the pledge should also not amount to transfer from pledgee to the pledgor. |

|

Sale of pledged goods |

Yes. While the pledgee does not have the title to the pledged securities, the Contract Act empowers the pledgee to cause the sale and convey good title to the buyer. It would appear from the movement in demat accounts as if the shares have been transferred from the demat account of the pledgee to that of the buyer; however, in legal parlance, the sale has occurred from the pledgor to the buyer. |

Overview of the Applicable Provisions under the Takeover Regulations

“Pledge” is covered within the meaning of ‘encumbrance’ under the Takeover Regulations. This, obviously, refers to the creation of the pledge. A release of the pledge will be a case of removal of the encumbrance.

While regulations 31 of the SEBI Takeover Regulations deals with disclosure requirements for the promoters, regulation 29 deals with the disclosure requirements for the acquirer, including the pledgee, based on prescribed thresholds. The triggers for obligation to make an open offer is provided under regulations 3 and 4. Regulation 10 of the Takeover Regulations provides the exemptions from the open offer obligations. Presently, if the open offer obligation gets triggered pursuant to invocation of pledge by the pledgee, the exemption is provided only to scheduled commercial banks and public financial institutions.

Conflicting Compliance Requirements in View of the PTC India Ruling

In view of PTC India ruling, the pledgee is not permitted to own the pledged property. Accordingly, the acquisition by the pledgee is only to be able to cause a sale of the pledged securities to third parties or redeeming the pledged securities back to the pledgor, in terms of section 177 of Contract Act where the pledgor settles the amounts before a sale of pledged goods by the pledgee to the third party.

In such a case, the exemption under regulation 10 of the Takeover Regulations extended to scheduled commercial banks and public financial institutions becomes redundant as invocation of a pledge will not result in an acquisition of beneficial ownership by a pledgee. Similarly, a redemption of pledged property to the pledgor will also have the effect of a release of the pledge and cannot be regarded as a fresh transaction resulting in disposal by the pledgee and acquisition by the pledgor, as the pledgee is not entitled to retain title in the pledged securities. While the rationale provided by Securities Appellate Tribunal (SAT) in Liquid Holdings Private Limited v. The Securities Exchange Board of India has not been overruled by the Supreme Court, it must effectively be taken as redundant. If the retention of shares by the lender is not a transfer, then the release following payment by the borrower cannot be a case of acquisition by the borrower or pledgor. Hence, the question of any open offer does not arise.

Applicability of Takeover Regulations to Various Stages of Pledge Following the PTC India Ruling

Creation of pledge: This will attract disclosure obligations under regulation 29 of the SEBI Takeover Regulations in case the thresholds are breached and regulation 31 in case of pledge by promoters and persons acting in concert (PACs).

Release of pledge: This will attract disclosure obligations under regulation 29 in case the thresholds are breached and regulation 31 in case of pledge by promoters and PACs.

Notice of invocation of pledge: No compliance requirement arises under the Takeover Regulations as it results in neither acquisition nor disposal.

Invocation of pledge: This will attract disclosure obligations under regulation 29 in case the thresholds are breached and regulation 31 in case of pledge by promoters and PACs. In view of the rationale provided in PTC India ruling, it will not attract open offer obligations even if the acquisition attracts regulations 3 or 4, as registration of the pledgee as a beneficial owner in terms of the SEBI Depositories Regulations is only to enable sale of the pledged securities in terms of section 176 of the Contract Act.

Redemption of pledged securities: This will attract disclosure obligations under regulation 29 in case the thresholds are breached and regulation 31 in case of settlement of pledge by promoters and PACs. However, in view of rationale provided in the PTC India ruling, a re-transfer of pledged securities upon settlement of dues by the pledgor should not attract open offer obligations even if the redemption of pledged securities attracts regulations 3 or 4, as the pledgee derived the right to acquire beneficial ownership only to exercise its remedy under the Contract Act and, upon settlement of the dues, the said right stood terminated.

Sale of pledged securities: A sale of pledged securities by the pledgee to a third party will attract disclosure requirements under regulation 29 for the acquisition by the said third party in case the thresholds are breached. It will also attract open offer obligations for the third party in case the acquisition attracts regulations 3 or Reg. 4.

Conclusion

The PTC India ruling reiterates the need to align the exemptions and compliance requirements under the Takeover Regulations with the governing provisions of the Contract Act, keeping in view the various stages involved in a pledge transaction and to avoid discord or ambiguity resulting in instability or confusion. Considering the pledgee as the beneficial owner and treating re-transfer of pledged securities as an acquisition by the pledgor would result in a deviation from the underlying principles of pledge as detailed in the Contract Act.

– Vinita Nair