[Rajeev Jhawar is an Executive at Vinod Kothari Consultants Pvt Ltd]

As part of the budget this year, India sought to expand its bond market beyond the traditional ambit of sovereign debt. Pursuant to this, Securities and Exchange Board of India (SEBI) has initiated efforts to diversify borrowings of Indian corporates by mandating them to raise at least a quarter of their incremental funds from the bond market. The regulator came out with a consultation paper in order to address the liquidity problem persisting in the bond market, with an intention to create a robust secondary market for the debt securities in India.

SEBI’s proposal and corresponding inferences

The regulator proposed that listed companies with outstanding long-term borrowings of Rs. 100 crores and a credit rating of “AA and above” will have to compulsorily raise 25% of their debt from the bond market from the next financial year. Lower rated corporates have been exempted from the framework for the time being due to the limited demand for such securities.

It is believed that if the 25% norm is followed religiously, it would tantamount to increased bond floatation as more companies would be able to access the debt market. Ideally, the move should provide insurance companies, provident funds and pension funds an opportunity to invest in high yielding instruments and open up a new funding avenue for lower-rated companies. Besides, the government might limit corporates’ dependence on banks and the risk associated with it. However, there is a need for an expansion in the investor base for implementation of these rules.

Rationale

There is no secondary market for corporate bonds in India to speak of. The sorry state of affairs could be because of an illiquid debt market, negative press in case of default, a risk averse attitude as well as dearth of investor awareness.

On the bright side, bonds are an ideal way to raise financing for certain kinds of infrastructure projects. Typically, such projects are capital-intensive and involve a long gestation period. It takes years to roll out toll-roads, build flyovers and set up massive power generating plants. The project developer has no cash flow to service debt until the project is running and banks may not be considered a viable source as bank funding is short tenure, which would result in asset-liability mismatch.

A sound corporate bond market would take a lot of pressure off banks, which are reeling under bad debts. Retail investors will also get a chance to invest in such projects via debt funds. In short, large exposure to risk would be substantiated with huge rewards.

The issuer-issuance conundrum

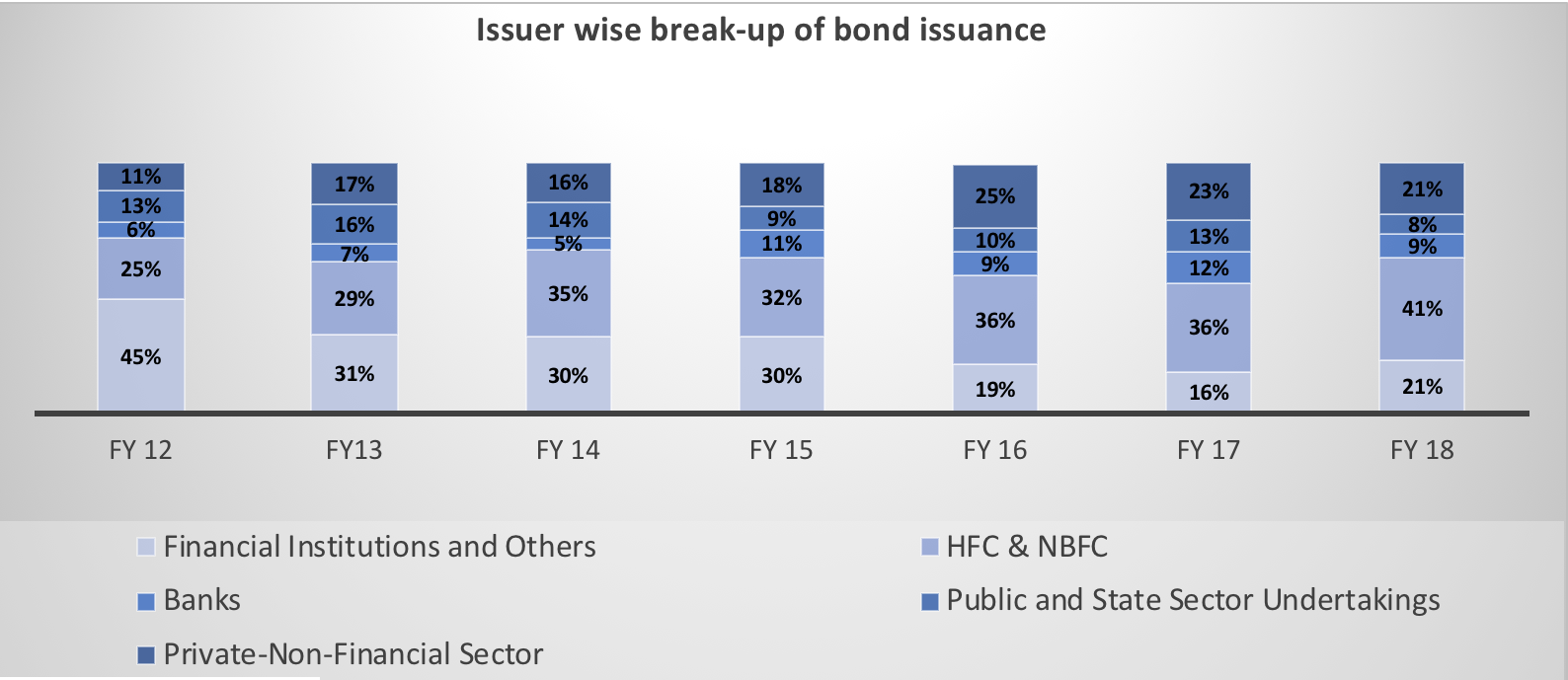

| Source: CRISIL |

The above chart demonstrates the issuance by different types of entities. It is palpable that almost 60% to 70% of the total issues are carried out by financial sector entities and the private sector non-financial entities constitute only around 20% of the total issuance. One of the major reasons for this huge concentration among the financial institutions is the relaxation with respect to debenture redemption ration (DRR) enjoyed by them. In order to liberalize the regulatory framework for all types of issuers, there is a proposal to do away with it for all types of issuers.

Debenture Redemption Reserve (DRR)

As noted above, financial sector companies, including NBFCs, are currently exempted from the requirement of maintenance of DRR for debenture issuance on private placement basis, whereas all issuances by non-financial entities and entities carrying out public issues are required to set aside a part of their profits (equivalent to 25 % of the value of outstanding debentures) as DRR. Besides, such companies have to invest at least an amount equivalent to 15% of the debentures maturing during the year in bank deposits, government securities, etc. Such an earmarking of funds imposes an opportunity cost on the issuer.

The SEBI consultation paper provides that maintenance of DRR imposes a significant cost on the public issue of bonds and on bonds issued on private placement basis by non-financial corporates. Given that the issue of protection of bond investors in cases of default has been significantly addressed by the enactment and operationalization of Insolvency and Bankruptcy Code, it is felt that if the requirement of DRR is dispensed with, it will naturally facilitate more corporates to access the bond market for their financing needs.

Investment Grade

The need to invest in bonds with lower ratings and deviating from ‘AA’ to ‘A’ grade ratings would impact pension and provident funds more because they have largely invested in AAA-rated securities. As of today, even the provision to invest in up to AA-rated instruments is hardly explored by most of the larger investors. Corporate bonds rated ‘BBB’ or equivalent are investment grade. In India, most regulators permit only bonds with the ‘AA’ rating as eligible for investment. However, this case may not hold true post SEBI’s proposal.

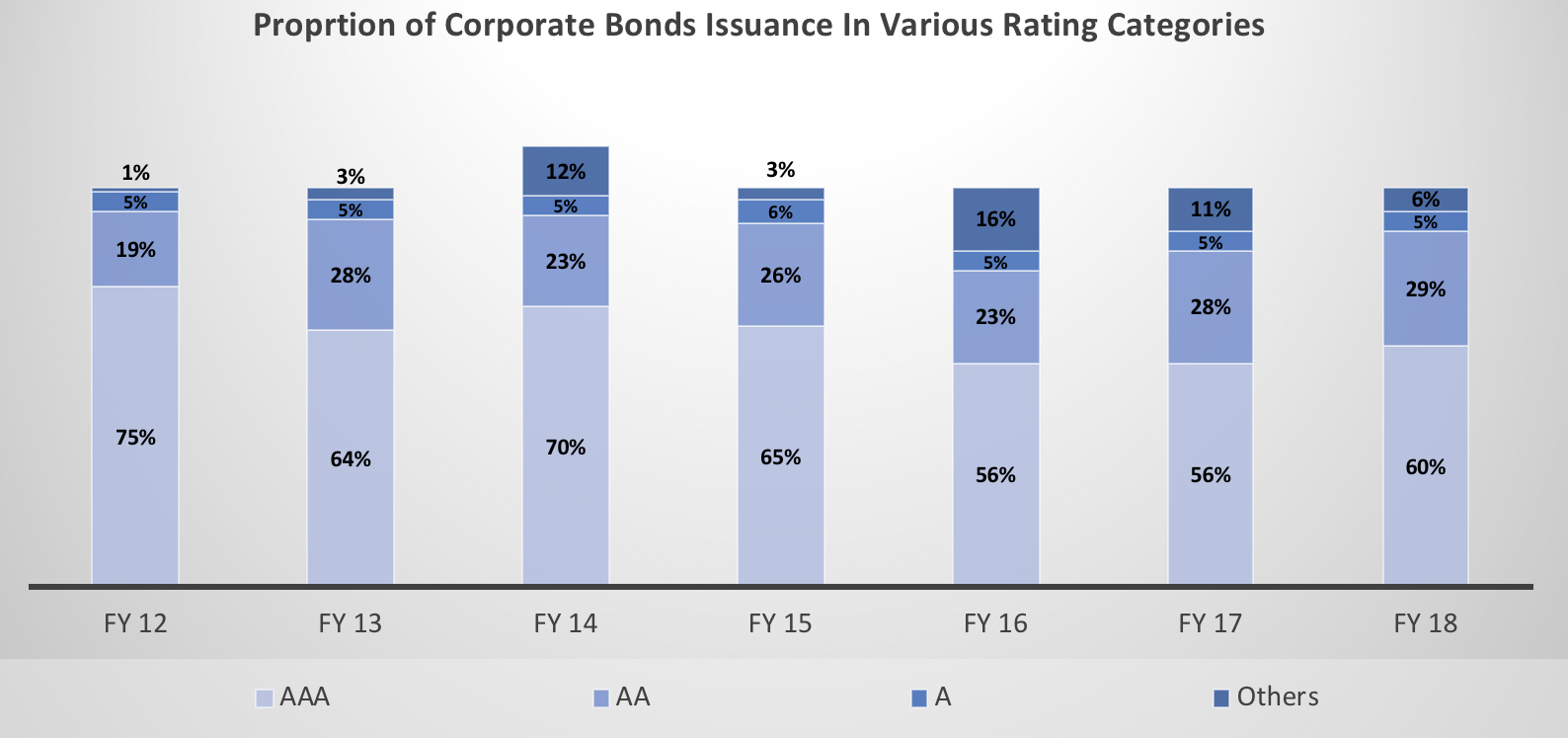

Source: CRISIL

As per SEBI, in 2016-17, 51 percent of total borrowings came from bonds compared to 37 percent in 2012-13, a good indication for deepening the bond market. However, borrowings are still heavily skewed towards high-rated borrowers, with 90 percent of the issuances concentrated in the AA and AAA rated categories. In light of the extant depth structure of the bond markets, one may suppose that the proposed rules should not be onerous for corporates.

Impact on Financier’s Interest

The entry barrier for lower rated corporate bonds would be demolished because the proposal might escalate the pool of investment grade issuers. So far, small borrowers resorted mostly to institutional finance and inter-corporate deposits. The bond avenue would serve as an alternative for them to raise finance at a reasonable price keeping in mind investor’s perpetual keenness to diversify their investments. It may be useful to classify BBB-rated corporate bonds as investment grade and thus allow pension funds and insurance companies to enter that space.

Compliance

SEBI proposed a “comply or explain” framework for the new rules. This means that companies would need to disclose non-compliance as part of “continuous disclosure requirements”. Further, from third year of implementation i.e. financial year 2021-22, the requirement of bond borrowings shall be tested for a contiguous block of two years i.e. financial years 2021-22 and 2022-23, which will be treated as one block and the requirement of 25% borrowing through bond market shall be complied with for the sum of incremental borrowings made across the period of the block. At the end of block if there is any deficiency in the requisite bond borrowing, a monetary penalty in the range of 0.2% to 0.3% of the shortfall shall be levied.

Whether SEBI’s attempt would prove to be a boon or a bane is likely to be seen as days unfold.

– Rajeev Jhawar