In the case of Assistant Director of Income Tax v. M/s E-Funds Solution Inc.,[1] the Supreme Court of India delivered an important decision regarding the Permanent Establishment status of outsourcing functions provided by various information technology (IT) companies in India. The Court held that provision of support service by an entity in India would not make the entity a Permanent Establishment of a foreign entity. In this post, I explain the judgement and point out the lacunae in work carried out by the Assessing Officer which has wide consequences to the IT sector.

Factual Matrix

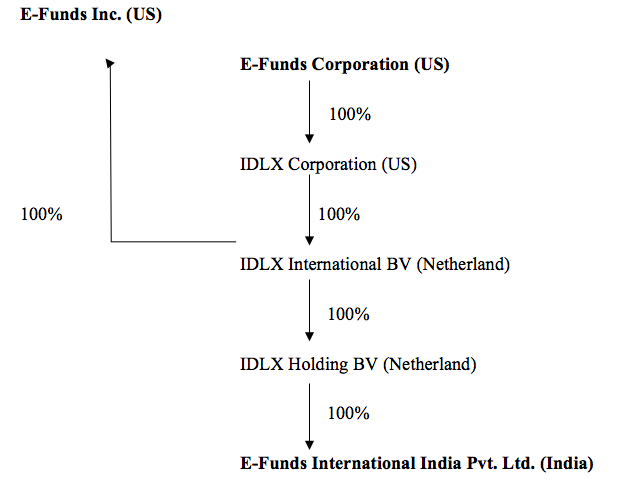

The assessees in the said case are E-Funds Corporation and E-Funds IT Solutions Group Inc. The aforesaid entities are incorporated in the United States (US) and are tax residents of the US. E-Funds Corporation, through various layers of subsidiaries, owns 100% shareholding in E-Funds International India Private Limited, a company incorporated in India.

The following diagram will illustrate the structure of their arrangement:

Therefore, E-Funds India is indirectly a wholly owned subsidiary of E-Funds Corporation. E-Funds India owned certain call centres and software development centres. Both E-Funds Corporation and E-Funds Inc. entered into international transactions with E-Funds India for the provision of various back office and outsourcing services. The said international transactions were examined and concluded to be at arm’s length price by the Transfer Pricing Officer of the Revenue. Further, a President was appointed who provided the marketing management and support services to overseas entities. However, the nature of services rendered by the President is not known. The payment in relation to the said services was received by E-Funds India. The President also managed certain group entities of E-Funds Corporation. The employees of these entities reported to the President who further reported to E-Funds Corporation. However, the nature of information being reported is not known. Upon an examination of various agreements and arrangements between the parties, the Revenue was of the opinion that E-Funds India was a Permanent Establishment of E-Funds Corporation under article 5 of the double taxation avoidance agreement (DTAA) between India and the US, and should be liable to be taxed to the extent of its profits attributable to its operations in India under article 7 of the India-USA DTAA. Since tax was paid by E-Funds India on certain profits in India under domestic law, the Revenue imposed tax liability only towards profits arising out of those operations of E-Funds India carried out in India which were not taxed under domestic law.

Issues

I. Whether E-Funds India is a fixed place permanent establishment (‘Fixed PE’) of E-Funds Corporation?

II. Whether E-Funds India is a Service Permanent Establishment of E-Funds Corporation?

III. Whether any profits should be attributed to the Permanent Establishment, if it exists at all, when the transactions were entered on arm’s length price?

IV. Whether the findings and outcomes of Mutual Agreement Procedure (MAP) under article 27 of India-USA DTAA for particular assessment year can be relied upon for subsequent years?

Decision

I. Whether E-Funds India is Fixed PE of E-Funds Corporation?

In order to constitute Fixed PE, the assessee must, first, have a fixed place of business and, second, that place should be at its disposal. The assessee should exercise sufficient control over the said place. Therefore, it was held that the risk, function and asset criteria cannot be considered for determination of the same. Further, the Court listed out a number of factors which are not relevant for determining Fixed Place PE. The following are the factors:

(2) E-Funds does not bear sufficient risk;

(4) Direct and indirect costs of software development centre or Business Process Outsourcing are paid by E-Funds Corporation and other corporate allocations made by E-Funds Corporation to E-Funds India

It further held that merely because the assessee reduced its expenditure by transferring certain business operations and back office operations to E-Funds India, that itself would not constitute a Fixed Place PE. Lastly, it held that the services provided by E-Funds India were merely support services; therefore, no part of main business activity of the assessee was situated in India. Thus, E-Funds India was not a Fixed Place PE of E-Funds Corporation.

II. Whether E-Funds India is a Service PE of E-Funds Corporation?

In order to constitute Service PE under article 5(2)(l), the requirement is that an enterprise must furnish services ‘within India’ through its employees or other personnel. In the instant case, none of the customers were located in India nor received any service in India. All the customers received services outside India. Only auxiliary operations which facilitate such services were carried out in India. Therefore, since no services were rendered in India, it was held that there does not exist any Service PE.

III. Whether any profits should be attributed to the Permanent Establishment, if at all it exists when the transactions have been conducted on arm’s length price?

It was held that even if E-Funds India is considered as a Permanent Establishment of E-Funds Corporation, no profits can be attributable to operations of E-Funds India as the transactions entered in to between E-Funds India and E-Funds Corporation and E-Funds Inc. were based on arm’s length price. Since E-Funds India was already taxed on all its profits under the domestic law, there does not exist any profits which needs to be taxed in the hands of the assessee.

IV. Whether the findings and outcomes of a Mutual Agreement Procedure (MAP) of a particular assessment year can be considered as a binding precedent for subsequent assessment years?

After following the Mutual Agreement Procedure (MAP) between the competent authorities of India and the US, E-Funds India was considered as a Permanent Establishment of both E-Funds Corporation and E-Funds Inc. It was considered as a Permanent Establishment of E-Funds Corporation for the assessment year 2003-04 and that of E-Funds Inc. for assessment year 2004-05. Further, certain profits were attributed to the Permanent Establishment in the abovementioned assessment years, and the same were taxed in India. The Revenue relied upon the same in order to provide justification for imposing tax for the subsequent years. However, the said justification was negated and it was held by the Court that outcomes of MAP Procedure are case specific. Therefore, the results of MAP Procedure in a particular assessment year cannot be relied upon and used as a precedent for subsequent assessment years.

It may be noted that the assessees fall under the ambit of taxation under the domestic law as well. Under section 9(1) of the Indian Income Tax Act, 1961, if a person has a business connection in India and the income is attributable to the said business connection, that income is said to be deemed to accrue or arise in India. Any income which is deemed to accrue or arise in India is chargeable to income tax in India.[2] In the case of both the assessees, the High Court of Delhi held that there existed a ‘business connection’. However, the High Court did not hold the assessees liable for payment of tax under the said provisions. It was of the opinion that since the provisions of India-US DTAA are more beneficial to the assessees than the provision of Indian Income Tax Act, the assessees should be taxed in accordance with the provisions of the said DTAA.[3]

Critique

The judgement delivered by the Supreme Court on the issues placed before it is indeed in consonance with the internationally adopted law on Permanent Establishment. The Supreme Court provided a welcome clarity to Indian IT industry regarding their status as outsourcing entities. However, this judgement does give an opportunity to point out the lack of proper approach taken by the Assessing Officer. The Assessing officer did not enquire about the nature of management services provided by the President. Further, the details of the information which was reported by the employees of the group entities to the President was also not enquired. If the Assessing Officer would have undertaken the aforesaid fact-finding task with utmost diligence, a sufficient clarity would have been provided in relation to a very important proposition, i.e. whether E-Funds India is a Dependent Agent PE of E-Funds Corporation. Even though the said question was raised before the Supreme Court, the Court did not answer the same because of the lack of sufficient facts. The decision on the said proposition would have had wide ramifications on the entire IT industry which is largely outsourcing-based. Further, the said decision would have provided the necessary clarity to the overseas companies. It would have been of great help to structure its investment decisions accordingly.

– Akash Santosh Loya

[1] Assistant Director of Income Tax v. M/s. E-Funds IT Solution Inc., [2017] 86 taxmann.com 240.

[2] Section 4, Income Tax Act, 1961

[3] Section 90(2), Income Tax Act, 1961.