[Post by Shreya Rao]

The ruling of the Delhi Income Tax Appellate Tribunal (ITAT) in the case of NDTV presents a poor picture of all actors. NDTV’s transactions fail to pass the smell test. The framing of the revenue’s position fails to convince you that NDTV’s smelly transactions should trigger a tax under law. The ruling itself is a 385-page tome written in the stream of consciousness style. It is repetitive, tediously unclear on facts and conveys the impression that the bench has made up its mind in favour of the revenue without due reasoning. This is unfortunate because the political context already compels you to take everything you read with a pinch of salt.

Thankfully, the Delhi High Court came out with a far more balanced & lucid ruling earlier this month, in the case of the same taxpayer on a related but different set of issues (it upheld the provisional attachment of NDTV’s assets for a different assessment year). This threw some light on the facts, and the analysis below reads both cases together for an understanding of what transpired.

The facts are complex

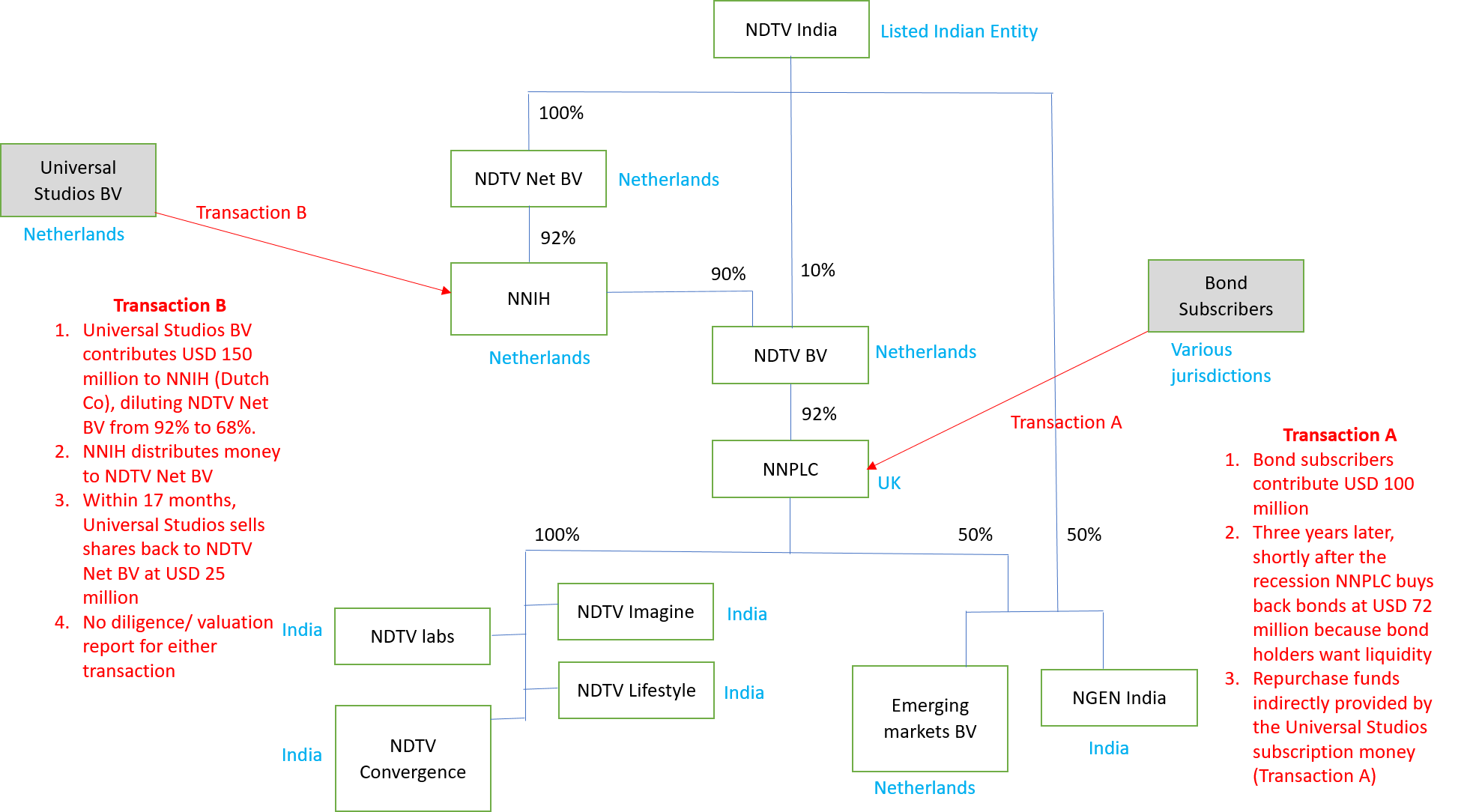

- NDTV India is a listed Indian entity in the news broadcasting space. In the four years following assessment year (AY) 2007-08, it created around 21 subsidiaries of which 11 were set up offshore (4 in Mauritius, 4 in the Netherlands, 1 each in the United Kingdom (UK), Sweden and the United Arab Emirates (UAE)). The rest were in India.

- The offshore subsidiaries (particularly those in the UK and Netherlands) received about USD 270 million (Rs. 1127 crores) in investment between AY 2007-08 and AY 2009-10. Within a short period of time after the investment, the investors sold their shares back to the NDTV entities at a steep discount. Here is a simplified version of two important transactions under question:

- Step up Bonds: In AY 2008-09, an NDTV UK entity (NNPLC/ “NDTV UK”) received USD 100 million for the issuance of Step Up Coupon Bonds. The bonds were issued to funds backed by Lehman Brothers, Goldman Sachs and Credit Suisse.

- Three years later, NDTV UK repurchased the bonds for USD 72.4 million (about Rs. 290 crores). The lower repurchase price was justified by the crash in the global markets, which created a need for liquidity amongst the bond holders.

- The repurchase was funded by an unsecured loan which could be (indirectly) traced back to an investment made by Universal Studios BV (see details below).

- We have no details of how the original USD 100 million was used/ disposed by NDTV UK. NDTV’s explanation is that the amount was invested into NDTV Imagine, an Indian subsidiary of NDTV UK, which ran an entertainment channel that the NDTV group was trying to promote.

- Share Subscription Money: On 23 May 2008, NNIH (Netherlands) received USD 150 million (about Rs. 642 crores) as share subscription money from Universal Studios BV. The investment was well publicized and diluted the primary shareholder, NDTV Net BV, from a 92% shareholding to a 68% one.

- In the next financial year, i.e., on 14 October 2009, Universal Studios BV sold back NNIH shares to NDTV Net BV for Rs. 58 crores. This created a loss of Rs. 584 crores for Universal Studios BV.

- Universal Studios BV allegedly carried out no due diligence prior to either transaction, nor did it obtain a valuation report. (This is unusual for a listed company making a substantial investment.) NDTV’s position was that the values were negotiated between the parties based on the expected potential of the Indian market, and that the subsequent low price was due to the economic downturn in 2008 and non-achievement of potential by the entertainment business. The Tribunal ruling does not reference any paper trail or discussion between the parties documenting the non-performance of the business.

- However, the Tribunal does note that the Rs. 642 crores received by NNIH was distributed as dividend to NDTV Net BV soon after the investment. This is strange – if the purpose of the investment was for Universal Studios BV to fund the growth of entertainment businesses owned by NNIH subsidiaries, why were the funds distributed upwards to NDTV Net BV?

- NDTV Net BV then transferred the amounts to other NDTV entities. It invested Rs. 448 crores in NDTV Mauritius and gave the remaining Rs. 254 crores as an unsecured loan to NNPLC UK. NNPLC UK then used the money to buy out bond holders (discussed above). Meanwhile, NDTV Mauritius merged with NDTV One Holding Mauritius which merged with NDTV Studios, which then merged with NDTV India in 2012, thus sending the Rs. 448 crores into India.

- Most of the offshore entities mentioned above stood liquidated by 2012-13.

- Non-disclosure by NDTV: The revenue alleged that the offshore subsidiaries of NDTV were paper companies and that it had received complaints from members of the Parliament and members of the Bar alleging largescale money laundering and evasion. They claimed that NDTV had not complied with its disclosure requirements for the foreign subsidiaries, which made it difficult for the revenue to determine if there was any wrongdoing. NDTV claimed that it had complied with all requirements mandated by law. It is difficult to arrive at a conclusion as the chronology of events is confusing and the debate hinged upon a circular that was issued after the non-compliance by NDTV. However, the Tribunal relies on the non-disclosure as an aggravating factor in coming to its conclusions on anti-avoidance.

- The core question: This post focuses on the investment and divestment by Universal Studios, arguably the most inexplicable aspect of this case. It will examine three questions: (a) whether the transaction fell afoul of specific anti-avoidance rules applicable at that time; (b) whether the arrangement was a sham, and there was evidence sufficient to pierce the corporate veil; and (c) if the responses to the first two questions are negative, whether it is desirable to extend tax jurisdiction to NDTV, on moral rather than legal grounds. (The latter question may be considered in light of the tone of the Tribunal ruling and recent debates surrounding the morality of aggressive tax planning)

Since these are substantial questions, I will be discussing the first one in Part 1 in this series of posts, and the next two questions in Part 2. There were several other issues regarding maintainability, treatment of software expenses, commission payments under section 40(a)(ia), disallowances under section 14A, transmission and uplinking charges and employee stock option (ESOP) expenditure payments etc. which are not being examined here.

Key Legal Issues

The crux of the revenue’s arguments regarding the Universal Studios transactions is as follows:

– that the subscription amounts received by NNIH from Universal Studios were taxable under sections 69A and 68 of the ITA (see page 148 of the ITAT ruling); and

– the amounts were taxable in the hands of NDTV India, even though received by NNIH, as the whole transaction was a sham, and the controlling stake of NDTV India in offshore subsidiaries called for a piercing of the corporate veil. (see page 154 of the ITAT ruling)

- Whether sections 68 and 69A can be applied to the current case

Revenue’s position: The assessing officer (AO) was of the view that sections 68 and 69A are applicable (a) because of the complicated ownership structure of the Universal Studios entity, which was owned by GE through a hierarchy of Dutch and Bermudan special purpose vehicles (SPVs) and the NBC US entities; and (b) because Universal Studios invested into NNIH without a diligence or a valuation report, which led the AO to believe that the subscription price was not fair (and therefore covered by section 69A) (see pages 148 and 149 of the ITAT ruling).

Section 68 vs. Section 69A: Neither of the AO’s conclusions are supported by the text of sections 68 and 69A or precedents on the point. At the outset, the framing of issues is confused, as it is not possible for a charge to be levied under section 68 as well as section 69A – the two provisions have divergent scopes.

Section 68 relates to unexplained amounts appearing on the books while section 69A relates to amounts not appearing on the books. In this case, as NNIH received the sums as share subscription money and reflected it in its books, section 68 would be the appropriate provision. However, the revenue likely opted to proceed under section 69A, as section 68 would lead to a consequence where the amount is taxable in the hands of NNIH, a foreign entity (and not NDTV India). In comparison, the application of section 69A would only be justified on the basis that once the corporate veil is pierced, NNIH’s cash belongs to NDTV India, an entity that does not reflect NNIH’s share capital on its books. However, such an interpretation militates against the original purpose of section 69A, which was to determine the source of “unaccounted for funds”, rather than “funds accounted for improperly”. Unfortunately, the ruling does not address this difference with any degree of specificity or nuance.

Interpretation of sections 68 and 69A: The terms “nature and source” appear commonly in both sections 68 and 69A. Therefore, we may refer to case law under section 68 to determine the meaning of “nature and source” of share application money, even if section 69A is sought to be applied. (Case law under section 69A does not deal with share application money, as it is typically reflected on the books of the receiving company).

Under section 68, share application money received by assessees is taxable (and therefore considered to be from an inexplicable source) if the company is unable to prove: (a) the identity of the share applicants; (b) their creditworthiness, i.e., ability to purchase shares; and (c) genuineness of the transaction as a whole, i.e., that the transaction happened. (See CIT v. Youth Construction, 357 ITR 197 (Del). It is important to note that during the period relevant to the NDTV case, there was no onus on the assessee to prove the “source of source” or “origin of origin”. For example, if the credit was in the name of a close relative, the assesse could not be presumed to have knowledge of the source from which the depositor obtained the money. (See Tolaram Daga v. CIT (59 ITR 632 (Gauhati)). Section 69A involves an additional step as it relates to money that is unaccounted for – therefore, in order to apply the provision, it would be important to “prove ownership” of the funds by the taxpayer i.e. NDTV India.

Documents provided by assessee: The assessee sought to prove “identity” of the investor by furnishing charter and corporate documents of Universal Studios BV, “creditworthiness” by furnishing SEC filings made by NBC Universal and an annual report of GE (the parent of NBC) and “genuineness” by furnishing bank statements and audited accounts of NNIH demonstrating the fund flows from the investor to NNIH. They argued that the holding structure of NBC was publicly available and that all transactions were through banking channels. Based on these documents, they argued (correctly) that the requirements under section 68 should have been satisfied. These documents should also have led to an outcome in favour of the taxpayer regarding “nature and source” under section 69A.

Ruling & Analysis: However, the ITAT ruled in favour of the revenue, citing reasons similar to those argued by the revenue above, i.e., the complex layers of corporate entities and the suspect nature of a transaction where the investor performs no diligence or valuation.

With due respect to the ITAT, this conclusion is incorrect and not supported by sections 68 and 69A. Section 68 does not allow the AO a carte blanche, but limits discretion to questions of identity, creditworthiness and genuineness, terms which have been explained by precedent. The AO may believe that the price of a subscription was inexplicably high/low, or that the corporate structure is complex, but so long as the investor exists, has the ability/creditworthiness to invest the relevant amount, and it is demonstrated that the amount was invested, the onus then shifts to the AO to demonstrate why section 68 should apply. Section 69A applies similar criteria regarding “nature and source”.

In addition, while applying section 69A, it is illogical to say that NDTV India was the “owner” of funds in the assessment year on account of piercing of the corporate veil, and also the owner through a demonstrable money trail on account of a merger in 2012. If the corporate veil is pierced on account of abuse of legal form, all “pierced” entities cease to matter – it should then not make a difference under section 69A whether there is a subsequent corporate restructuring of NDTV entities or not. If on the other hand the veil is not pierced, a “money trail” or demonstration of de facto ownership by the ultimate parent would be important. It is unclear which path the Tribunal preferred.

So where does that leave us? While it is certainly difficult to explain some of the facts of the Universal Studios transaction, it is also not prudent to apply specific anti-avoidance rules (SAARs) with thoughtless abandon and lack of respect for precedent. Sections 68 and 69A were introduced to address money laundering by old school businesses (domestically). These provisions do not lend themselves well to profit-shifting through offshore structures, particularly in a situation where the ultimate beneficial owner is a listed entity and the investments are made through banking channels. Perhaps the ITAT could have recognized this vacuum and chosen to adopt an expansive meaning of the term “genuineness” after analyzing prior case law. It is problematic that it chose, instead, to apply and expand the open-ended terms of sections 68 and 69A casually, without a discussion on their limits under precedent. The Indian general anti-avoidance rule recognizes and seeks to address some of these limits imposed by a SAAR based regime – however, it was not applicable at the time the NDTV transaction took place. A similar arrangement today would likely meet with very different treatment.

– Shreya Rao

Leave a comment