[The following post is contributed by Vinod Kothari of Vinod Kothari &

Co. The author may be contacted at [email protected]]

Co. The author may be contacted at [email protected]]

Voluntary

winding up under the Companies Act, 1956 has been segregated into two different

types, i.e. members’ voluntary winding up and creditors’ voluntary winding up.

But the Companies Act, 2013 eliminated distinction between members’ voluntary

winding up and creditors’ voluntary winding up by making creditors’ approval

necessary in all cases. Part II of Chapter XX of the Companies Act, 2013

comprising sections 304 to 323 deals with voluntary winding up. This sections

have not been notified till date and shall be omitted pursuant to section 255

read with eleventh schedule of the Insolvency and Bankruptcy Code, 2016[1]

(‘the Code’).

winding up under the Companies Act, 1956 has been segregated into two different

types, i.e. members’ voluntary winding up and creditors’ voluntary winding up.

But the Companies Act, 2013 eliminated distinction between members’ voluntary

winding up and creditors’ voluntary winding up by making creditors’ approval

necessary in all cases. Part II of Chapter XX of the Companies Act, 2013

comprising sections 304 to 323 deals with voluntary winding up. This sections

have not been notified till date and shall be omitted pursuant to section 255

read with eleventh schedule of the Insolvency and Bankruptcy Code, 2016[1]

(‘the Code’).

The run-up to voluntary

liquidation option

liquidation option

Irrespective

of the oft-repeated concern about the slow pace of liquidation proceedings in

India, both compulsory and voluntary, the provisions of law on winding up of

companies have continued to evolve.

of the oft-repeated concern about the slow pace of liquidation proceedings in

India, both compulsory and voluntary, the provisions of law on winding up of

companies have continued to evolve.

As

regards methods of winding up, the Companies Act, 1956 followed the provisions

of the UK Companies Act, 1948 in distinguishing between 3 modes of winding up:

regards methods of winding up, the Companies Act, 1956 followed the provisions

of the UK Companies Act, 1948 in distinguishing between 3 modes of winding up:

(a) Compulsory

winding up by the court;

winding up by the court;

(b) Voluntary

winding up, classified into:

winding up, classified into:

(i) Members’

voluntary winding up;

voluntary winding up;

(ii) Creditors’

voluntary winding up;

voluntary winding up;

(c) Voluntary

winding up subject to supervision of court.

winding up subject to supervision of court.

The

last of these, voluntary winding up subject to supervision of court, had long

back become antiquated and dysfunctional. This actually meant a voluntary

winding up, where the creditors or the members approach the court to bring the

winding up to supervision of the court, presumably to secure justice.

Evidently, the purpose may have been more creditors’ protection, who may feel

insecure in a members’ voluntary winding up. Palmer’s Company Law[2]

mentions that post the introduction of creditors’ voluntary winding up in 1929,

this method had been rarely used. In India, the Eradi Committee also mentioned

that this method had become redundant.[3]

last of these, voluntary winding up subject to supervision of court, had long

back become antiquated and dysfunctional. This actually meant a voluntary

winding up, where the creditors or the members approach the court to bring the

winding up to supervision of the court, presumably to secure justice.

Evidently, the purpose may have been more creditors’ protection, who may feel

insecure in a members’ voluntary winding up. Palmer’s Company Law[2]

mentions that post the introduction of creditors’ voluntary winding up in 1929,

this method had been rarely used. In India, the Eradi Committee also mentioned

that this method had become redundant.[3]

This

leaves us with two options – winding up on orders of the court (or compulsory

winding up), and voluntary winding up. Voluntary winding-up is like private

liquidation proceeding – the intervention of courts is limited, and comes

essentially at the time of obtaining final orders for dissolution. While

normally it will be expected that a company opting to wind up voluntarily is a

solvent company, there are situations where the company may not be solvent –

hence, the law distinguished between members’ voluntary winding up and

creditors’ voluntary winding up. In case of a members’ voluntary winding, the

directors are required to make a declaration of solvency, which, to put

succinctly, is an affirmation that the company has enough assets to pay all its

creditors, and if the company is unable to so pay, it shall be presumed that

the declaration was wrongly made, exposing the directors to prosecution.

leaves us with two options – winding up on orders of the court (or compulsory

winding up), and voluntary winding up. Voluntary winding-up is like private

liquidation proceeding – the intervention of courts is limited, and comes

essentially at the time of obtaining final orders for dissolution. While

normally it will be expected that a company opting to wind up voluntarily is a

solvent company, there are situations where the company may not be solvent –

hence, the law distinguished between members’ voluntary winding up and

creditors’ voluntary winding up. In case of a members’ voluntary winding, the

directors are required to make a declaration of solvency, which, to put

succinctly, is an affirmation that the company has enough assets to pay all its

creditors, and if the company is unable to so pay, it shall be presumed that

the declaration was wrongly made, exposing the directors to prosecution.

There

may be situations where the assets are either insufficient to pay all

creditors, or the directors are unwilling to make the declaration. In such

cases, the company will be put under “creditors’ voluntary winding up”. The

terms “creditors’ voluntary winding up” seems like a self-contradictory

expression, since “voluntary” would mean at the instance of members. However,

while creditors’ voluntary winding up is also initiated at the instance of the

members, it is just that creditors have intrusive control over this process,

since the company is presumably not a solvent company.

may be situations where the assets are either insufficient to pay all

creditors, or the directors are unwilling to make the declaration. In such

cases, the company will be put under “creditors’ voluntary winding up”. The

terms “creditors’ voluntary winding up” seems like a self-contradictory

expression, since “voluntary” would mean at the instance of members. However,

while creditors’ voluntary winding up is also initiated at the instance of the

members, it is just that creditors have intrusive control over this process,

since the company is presumably not a solvent company.

The

following table shows the similarities and differences between members’

voluntary winding up and creditors’ voluntary winding up

following table shows the similarities and differences between members’

voluntary winding up and creditors’ voluntary winding up

|

Particulars

|

Members’ voluntary

winding up |

Creditors’ voluntary

winding up |

|

Initiation of winding up

|

Resolution

of members – ordinary if the winding up is as per articles or expiry of the duration for which company was formed, otherwise, special – section 484 (1) |

Same

|

|

Commencement of winding

up |

On

the passing of resolution of shareholders – section 485 |

Same

|

|

Declaration of solvency

by directors |

Is

the demarcating line between members’ and creditors’ voluntary winding up [sec 488 (5)], hence required |

Does

not arise; however, the Board makes a statement of financial position [sec 500 (3) (c) ] |

|

Meeting of creditors

|

Not

required |

Mandatory

– sec 500. Resolution to be passed as per Rule 205 of Companies (Court) Rules |

|

Appointment of liquidator

|

By

the members [sec 490] |

By

the company as well as by creditors, but in case of a difference, creditors’ view prevails [sec 502 (2)] |

|

Committee of Inspection

|

Does

not arise |

Creditors

may appoint the Committee of Inspection |

|

Annual meetings

|

If

liquidation proceedings stretch beyond a year, the liquidator shall call a general meeting every year [sec 496] |

If

liquidation proceedings stretch beyond a year, the liquidator shall call a general meeting of the company, as well as creditors’ meeting every year [sec 508] |

|

Final meeting

|

Final

meeting pre-dissolution is general meeting of the company [sec 497 (1) (b)] |

Final

meeting pre-dissolution is general meeting of the company as well as meeting of creditors [sec 509 (1) (b)] |

The

distinction between members’ voluntary winding up and creditors’ winding up is

significant, and was retained in section 90 of the UK Insolvency Act as

well. The distinction exists in Hong

Kong and Singapore as well.

distinction between members’ voluntary winding up and creditors’ winding up is

significant, and was retained in section 90 of the UK Insolvency Act as

well. The distinction exists in Hong

Kong and Singapore as well.

An

issue that arises is – if company is indeed insolvent, why will the creditors

opt for a voluntary winding up, and instead, why would they not force the

company to go into compulsory winding up on the ground of inability to pay?

Several reasons explain this:

issue that arises is – if company is indeed insolvent, why will the creditors

opt for a voluntary winding up, and instead, why would they not force the

company to go into compulsory winding up on the ground of inability to pay?

Several reasons explain this:

– First, the creditors’ voluntary winding

up is not winding up forced by the creditors – it is a members’ option; just

that the company is either not solvent or the directors are unsure of the

solvency.

up is not winding up forced by the creditors – it is a members’ option; just

that the company is either not solvent or the directors are unsure of the

solvency.

– Second, and very importantly – where a

creditor goes to court on account of inability to pay, it is taking an

individual action against the company. Where creditors, although at the

instance of members, pass a resolution for liquidation, they are taking a

collective action. The court petition is

a contested matter, and normally, the company files tooth and nail to have this

petition dismissed. On the other hand, the creditors’ voluntary winding up is

initiated by the members in the first place; hence, this bears full consensus

of the members.

creditor goes to court on account of inability to pay, it is taking an

individual action against the company. Where creditors, although at the

instance of members, pass a resolution for liquidation, they are taking a

collective action. The court petition is

a contested matter, and normally, the company files tooth and nail to have this

petition dismissed. On the other hand, the creditors’ voluntary winding up is

initiated by the members in the first place; hence, this bears full consensus

of the members.

– Third, in case of court-ordered

liquidation, the liquidation is controlled by the official liquidators’

machinery, which may be slow, and may hamper value maximisation. Creditors may,

on the other hand, opt for the voluntary liquidation process where the

liquidator is appointed by the creditors.

liquidation, the liquidation is controlled by the official liquidators’

machinery, which may be slow, and may hamper value maximisation. Creditors may,

on the other hand, opt for the voluntary liquidation process where the

liquidator is appointed by the creditors.

While

these alternative options – individual pursuit by creditors before the court,

and collective decision of creditors based on a members’ wishes – has held good

ground in other countries, the Companies Bill 2008 reduced the winding up

options to only two – compulsory and voluntary.[4]

The underlying philosophy seems to have been that if the company is insolvent,

it may be taken to liquidation under compulsory liquidation process. Thus,

under the voluntary winding up option, both a declaration of solvency, as also

creditors’ resolution, were made mandatory. Thus, it be noted that while the

Companies Act, 1956 provided that the directors may make a declaration of solvency [section 488, Companies Act,

1956], the Companies Act, 2013 [section 305] says, the directors shall make a declaration of solvency.

Additionally, the 2013 Act makes the obtaining of creditors’ resolution also

necessary, and provides that if the creditors are of the view that the company

may not be able to pay its debts in full, then the company shall file a

petition for compulsory winding up [section 306 (3) (b)].

these alternative options – individual pursuit by creditors before the court,

and collective decision of creditors based on a members’ wishes – has held good

ground in other countries, the Companies Bill 2008 reduced the winding up

options to only two – compulsory and voluntary.[4]

The underlying philosophy seems to have been that if the company is insolvent,

it may be taken to liquidation under compulsory liquidation process. Thus,

under the voluntary winding up option, both a declaration of solvency, as also

creditors’ resolution, were made mandatory. Thus, it be noted that while the

Companies Act, 1956 provided that the directors may make a declaration of solvency [section 488, Companies Act,

1956], the Companies Act, 2013 [section 305] says, the directors shall make a declaration of solvency.

Additionally, the 2013 Act makes the obtaining of creditors’ resolution also

necessary, and provides that if the creditors are of the view that the company

may not be able to pay its debts in full, then the company shall file a

petition for compulsory winding up [section 306 (3) (b)].

Thus,

the process of creditors’ voluntary winding up came to an end, and Indian law

now has only two options – insolvent companies come for liquidation under

compulsory liquidation process, and solvent companies come for liquidation

under the voluntary liquidation process.

the process of creditors’ voluntary winding up came to an end, and Indian law

now has only two options – insolvent companies come for liquidation under

compulsory liquidation process, and solvent companies come for liquidation

under the voluntary liquidation process.

Is end to creditors’

voluntary liquidation justified?

voluntary liquidation justified?

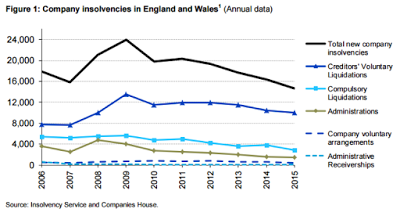

While

India has, thus, put an end to out-of-court liquidation of unhealthy companies,

the fact remains that creditors’ voluntary liquidation remains the most

important form of winding up of insolvent companies.[5] In

the UK,[6] as

per the estimates, total of 14,629 companies entered into insolvency in 2015.

Of which, total of 2,874 companies were subject to a compulsory winding-up

order, 9,981 companies entered into creditors’ voluntary liquidation, 357

companies opted for voluntary arrangement and there were an estimated 1,406

administrations in 2015.

India has, thus, put an end to out-of-court liquidation of unhealthy companies,

the fact remains that creditors’ voluntary liquidation remains the most

important form of winding up of insolvent companies.[5] In

the UK,[6] as

per the estimates, total of 14,629 companies entered into insolvency in 2015.

Of which, total of 2,874 companies were subject to a compulsory winding-up

order, 9,981 companies entered into creditors’ voluntary liquidation, 357

companies opted for voluntary arrangement and there were an estimated 1,406

administrations in 2015.

Conclusion

The

process of voluntary winding up shifts from the Companies Act/LLP Act to the

Code. However, all the matters are not shifted to the Code; the residual

matters of winding up by the NCLT still remain in section 271 of Companies Act,

2013. Thus, as regards companies, the winding up options are viz. under the Code or the Companies

Act, 2013. The Code does not extend its arm to include financial service

provider. Therefore, in case of financial service providers, until explicit

provisions are enacted, either the Companies Act 2013, and/or the relevant

special laws, will continue to prevail.

process of voluntary winding up shifts from the Companies Act/LLP Act to the

Code. However, all the matters are not shifted to the Code; the residual

matters of winding up by the NCLT still remain in section 271 of Companies Act,

2013. Thus, as regards companies, the winding up options are viz. under the Code or the Companies

Act, 2013. The Code does not extend its arm to include financial service

provider. Therefore, in case of financial service providers, until explicit

provisions are enacted, either the Companies Act 2013, and/or the relevant

special laws, will continue to prevail.

–

Vinod Kothari

Vinod Kothari

[1] Received

the assent of the President on the 28th May, 2016.

the assent of the President on the 28th May, 2016.

[2] 1982 edition, para 86-63.

[3] “There is hardly any matter which is referred for winding up

subject to supervision of the High Court under section 425. The entire

procedure is redundant. Compulsory winding up would take care of winding up

subject to supervision of the Court” – para 4.3

subject to supervision of the High Court under section 425. The entire

procedure is redundant. Compulsory winding up would take care of winding up

subject to supervision of the Court” – para 4.3

[4] This

seems surprising, since the N L Mitra

Committee had also appreciated the useful role played by the creditors’

voluntary winding up – “If the members of the company resolving to go for

voluntary winding up can not submit a certificate of solvency the voluntary

winding up procedure is regulated by the creditors with the help of a

liquidator or liquidators appointed by the creditors. Both Members’ voluntary

winding up and creditors’ voluntary winding up are cost and time efficient

modes of liquidation” [Page 16 of the Mitra Committee report, at https://indiacorplaw.in/wp-content/uploads/2016/06/20811.pdf ]

seems surprising, since the N L Mitra

Committee had also appreciated the useful role played by the creditors’

voluntary winding up – “If the members of the company resolving to go for

voluntary winding up can not submit a certificate of solvency the voluntary

winding up procedure is regulated by the creditors with the help of a

liquidator or liquidators appointed by the creditors. Both Members’ voluntary

winding up and creditors’ voluntary winding up are cost and time efficient

modes of liquidation” [Page 16 of the Mitra Committee report, at https://indiacorplaw.in/wp-content/uploads/2016/06/20811.pdf ]

[5] “Creditors’ voluntary liquidation (a form of liquidation usually

initiated by a shareholders’ resolution) is currently by far the most common

form of proceeding.” – Plymouth Law and Criminal Justice Review (2016) 1 at

http://www.plymouthlawreview.org/vol8/Hamish%20anderson.pdf

initiated by a shareholders’ resolution) is currently by far the most common

form of proceeding.” – Plymouth Law and Criminal Justice Review (2016) 1 at

http://www.plymouthlawreview.org/vol8/Hamish%20anderson.pdf

[6] Source: https://indiacorplaw.in/wp-content/uploads/2016/06/Q4_2015_statistics_release_-_web.pdf – site last visited on June 7, 2016.